Manufacturing Efficiency: AI and Augmented and Virtual Reality Applications

Executive Summary

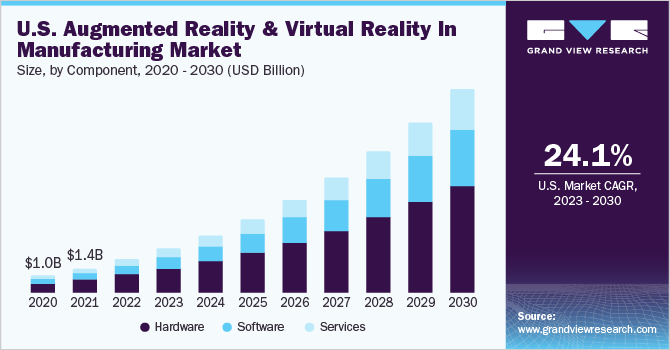

In an era of tightening margins and global competition, manufacturing leaders are turning to Artificial Intelligence (AI) and immersive technologies – Augmented Reality (AR) and Virtual Reality (VR) – to boost productivity, cut costs, and enhance workforce capabilities. Across the automotive, aerospace, and electronics sectors, these technologies are delivering tangible improvements in key performance indicators (KPIs). Manufacturers report reduced downtime (sometimes by as much as 50%), increased throughput and quality, expedited training, and significant cost savings due to AI-driven optimization and AR/VR-enabled process improvements. Major companies such as Toyota, Boeing, Lockheed Martin, Bosch, Siemens, and Samsung are investing heavily in AI for predictive maintenance and supply chain optimization, deploying AR/VR on factory floors for training and assembly guidance. The AR and VR solutions in manufacturing represented a roughly $8 billion market in 2022 and are projected to grow at approximately 28% annually this decade, highlighting their increasing significance. This executive report details how automotive, aerospace, and electronics manufacturers leverage AI, AR, and VR through case studies and data, and offers recommendations for leaders to capitalize on these technologies.

Key highlights include:

- Automotive: AI-based predictive maintenance and quality control (e.g., Toyota, BMW) are reducing unplanned downtime and defects, while AR and VR are streamlining complex assembly tasks and accelerating worker training at companies like Volkswagen and BMW.

- Aerospace: AR is enabling more efficient assembly of high-complexity products (Boeing’s wiring harnesses, Lockheed Martin’s spacecraft) with zero errors and faster completion. VR is used for design simulations and immersive training at Boeing, reducing the need for costly physical prototypes.

- Electronics: AI-driven analytics (Bosch, Samsung) improve production yield and energy efficiency – Bosch’s AI system cut energy use by 18% at one plant – while AR/VR support complex manufacturing and maintenance tasks (Siemens’ VR training cut training time by 66%).

Each section below deeply explores these use cases, providing

data points, quotes from industry leaders, and visual charts to illustrate the impact on manufacturing efficiency. An executive-level conclusion offers recommendations for adopting these technologies to achieve similar gains.

Automotive Industry: Driving Efficiency with AI, AR, and VR

AI in Automotive Manufacturing

Automotive manufacturers have embraced AI to optimize production lines and supply chains. Predictive maintenance powered by AI is a game-changer for reducing costly downtime. Unscheduled equipment failures can cost auto manufacturers up to $2.3 million per hour in lost production. By installing sensors and employing AI analytics on factory equipment, companies like Toyota can predict failures before they occur and schedule maintenance proactively. In fact, manufacturers using AI-driven predictive maintenance report up to a 50% reduction in unplanned downtime and approximately 30% lower maintenance costs. For example, Toyota integrated AI into its assembly operations, resulting in savings of over 10,000 labor hours per year and significantly reduced line stoppages. Similarly, a McKinsey survey found that 64% of manufacturers experienced cost reductions after adopting AI in production, and 61% saw lower supply chain planning costs – improvements attributed to better yield, energy efficiency, and demand forecasting.

AI is also optimizing the automotive supply chain and logistics. Early adopters of AI in supply chain management have reduced logistics costs by approximately 15% and lowered inventory levels by 35% through more accurate demand sensing and dynamic planning. Procter & Gamble, a leader in manufacturing, utilized AI and IoT to automate warehouses – delivering about 7,000 SKUs via autonomous systems – and saved roughly $1 billion annually in supply chain costs. Automotive companies are following suit, leveraging AI to manage parts inventory and distribution in real-time. Volkswagen has implemented AI in production scheduling and even forklift routing in factories, reporting lead-time reductions of up to 50% in some instances through smarter, AI-guided operations.

Quality control is another area being transformed by AI. AI vision systems and machine learning models now inspect parts and identify defects that human inspectors might overlook. Bosch’s automotive electronics plant in Ansbach, Germany, employs an AI-based visual inspection system for solder joints on circuit boards (with 5,000–8,000 joints per board). The AI flags potential defects for human review, significantly reducing inspectors’ workload and improving accuracy by filtering out false alarms. The outcome is a higher first-pass yield and less rework. At BMW’s Regensburg plant, in-house AI models generate heat maps of production data to identify anomaly patterns; this has saved maintenance teams over 500 minutes of downtime per year (more than a full workday of production) on just one assembly line. As BMW data scientist Deniz Ince stated, “Optimal predictive maintenance not only saves us money, it also allows us to deliver the planned quantity of vehicles on time, which reduces a huge amount of stress in production.”

AR on the Automotive Factory Floor

Leading automakers are utilizing Augmented Reality to assist workers with complex assembly and maintenance tasks. AR overlays digital instructions onto the physical work environment – typically through tablets or smart glasses – helping employees complete tasks more quickly and accurately. For instance, BMW employs AR goggles during engine assembly training. Trainees benefit from visual step-by-step guidance overlaid on engine components, ensuring that each bolt is tightened in the correct order and at the appropriate torque. This interactive training allows one trainer to supervise three trainees simultaneously (as opposed to one-at-a-time previously) without compromising the quality of learning. The AR-guided process standardizes assembly work and minimizes mistakes on the line. BMW also applies AR for quality assurance: at its Munich tooling center, staff use a tablet to superimpose CAD blueprints onto large auto body tools, instantly checking the alignment of drill holes and features. This AR inspection method identifies deviations early and prevents delays in tool commissioning.

Other automakers utilize AR to enhance maintenance and changeovers. Mercedes-Benz and Ford have supplied maintenance crews with AR glasses that visualize machine internals and identify faulty parts, thereby reducing repair times. Volkswagen tested AR for service technicians, leading to quicker diagnostics and consistent repair quality. In logistics, DHL (a key automotive logistics partner) discovered that AR “vision picking” systems (smart glasses that display warehouse pick instructions) boosted warehouse picking productivity by 15–25% and nearly eliminated errors. This level of efficiency in parts logistics directly supports automotive production lines by guaranteeing the right components arrive just-in-time.

Perhaps the most prominent use of AR in the automotive industry is for assembly guidance and training. At BMW’s assembly academy, new hires practice putting together dashboard components with Microsoft HoloLens AR headsets. This system offers real-time feedback and evaluates trainees at the end of their sessions. Capgemini, a partner of BMW, has reported that this solution has “enhanced effectiveness on the shop floor” and minimized the time supervisors must spend overseeing training. Workers become skilled more quickly, aiding BMW in managing high product variety and shorter model cycles. The investment in AR training yields benefits in the form of fewer assembly errors and greater productivity when these workers join the line.

VR in Automotive Design and Training

Automotive firms have also adopted Virtual Reality to streamline design and enhance worker training. VR design simulation allows engineers to refine a vehicle or factory layout in a virtual environment before any physical prototypes or changes are made. Hyundai leveraged VR to create and evaluate virtual car prototypes, reducing design cycles and costs. According to Hyundai, VR design tools facilitated real-time collaboration and adjustments, enhancing quality early in development. Ford employs its virtual reality Immersive Vehicle Environment (FIVE) to enable designers and engineers worldwide to co-create new models in VR, identifying issues that would be costly to fix later in physical builds. By replacing some physical mock-ups with VR simulations, Ford and Hyundai have saved millions and accelerated time-to-market.

On the factory floor, virtual reality training immerses automotive workers in lifelike scenarios without disrupting actual production. Volkswagen has been a pioneer in VR training; in 2018, it announced plans to train 10,000 employees using VR for production and logistics tasks across its brands. VW developed over 30 VR training simulations with HTC Vive headsets for operations such as assembly sequence training and warehouse picking. The program was so successful that VW made VR training an integral part of its global workforce development. Other automakers report similar gains: a maintenance training program at Ford found that technicians learned new repair procedures 45% faster in VR than through conventional methods. Importantly, VR allows for the safe practice of dangerous or rare scenarios, contributing to a 70% reduction in workplace injuries at companies that implement VR training.

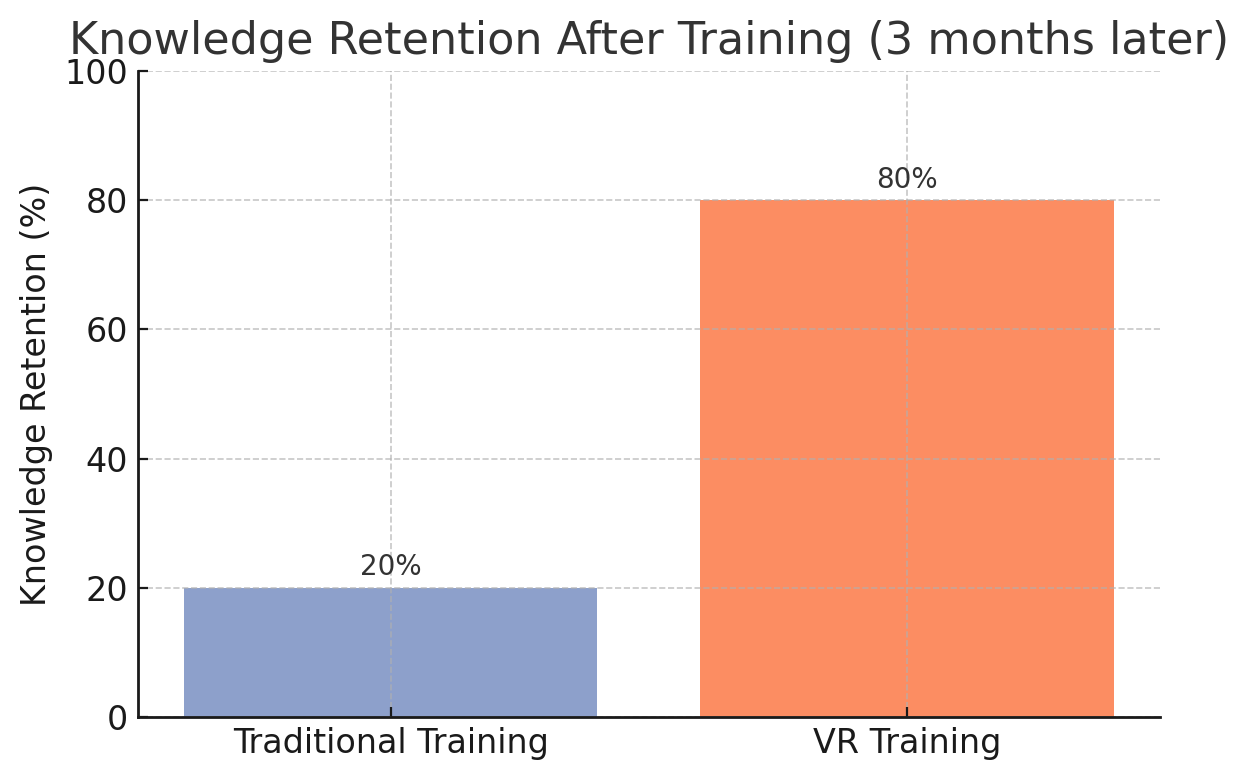

VR’s impact on knowledge retention and performance is remarkable. Studies indicate that employees trained in VR retain knowledge far better over time than those trained through lectures or manuals. One assessment found that VR-trained workers remembered 80% of learned skills after three months, compared to a mere 20% retention with traditional training. This fourfold increase in retention results in more competent workers on the line. Additionally, workers often demonstrate a performance improvement of over 30% on real tasks following VR training, due to the hands-on practice in a virtual yet realistic environment. Automakers benefit from increased labor productivity and fewer errors. For instance, simulator training for complex manufacturing tasks has significantly improved first-time-right metrics.

Automotive executives are increasingly viewing VR and AR not as experimental gadgets, but as practical tools to address skills gaps and production complexities. The

CEO of BMW’s production arm noted that immersive training has enabled the company to maintain quality with new staff despite high product variance.

Volkswagen’s leadership similarly recognized that scaling VR training across plants helped standardize best practices. The result is a more agile automotive workforce that can rapidly adapt to new models and processes – a critical advantage as the industry shifts to electric and autonomous vehicles requiring new manufacturing techniques.

Aerospace Industry: Reaching New Heights with AI, AR, and VR

AI in Aerospace Manufacturing

Aerospace manufacturing is characterized by extremely complex products, long lead times, and a zero-tolerance approach to errors. Here, AI assists in managing complexity and enhancing decision-making. Supply chain optimization through AI is vital in aerospace due to the tens of thousands of components in an aircraft or spacecraft. AI algorithms at Boeing and Airbus analyze demand, inventory, and production schedules to optimize parts flow and reduce bottlenecks. A McKinsey study noted that AI-enabled planning can improve service levels (on-time delivery) by up to 65% in complex manufacturing supply chains – crucial when late parts can delay an aircraft delivery.

In production, aerospace firms utilize AI for anomaly detection and quality assurance. For instance, Airbus has employed machine learning to identify tiny defects in carbon fiber fuselage parts through imaging, enhancing quality while minimizing manual inspection time. Lockheed Martin applies AI in its spacecraft assembly processes to correlate sensor data and test results, detecting process deviations early on. At Lockheed’s advanced manufacturing facilities, AI also organizes the schedules of autonomous guided vehicles, robots, and human tasks, optimizing the satellite and jet build processes. These AI-driven coordination tools have led to higher throughput – Lockheed’s COO indicated that some programs have experienced productivity improvements surpassing 10% after implementing AI scheduling and analytics, aiding in the achievement of aggressive production ramp-up targets for defense contracts.

One specific AI application involves the predictive maintenance of production machinery and avionics test equipment. A Boeing assembly plant equipped its machining centers and autoclaves with IoT sensors and an AI platform to anticipate maintenance needs. This reduced unexpected equipment downtime, ensuring that the critical path tools remain available. Boeing estimated that it saved several hundred hours of line stoppages in a year, which translates to millions in avoided costs, by preventing a key drilling robot from breaking down mid-shift. Furthermore, AI’s capability to analyze large datasets supports design optimization: Airbus has tested generative design (AI algorithms proposing design modifications) to lower weight and material usage in components, a result unattainable with traditional tools. These enhancements, though less visibly impactful than AR/VR, subtly boost aerospace manufacturing efficiency and cost-effectiveness – enabling companies to meet delivery targets and maintain quality in a more competitive market.

AR in Aerospace Manufacturing

Aerospace was one of the first industries to adopt AR at scale for assembly and maintenance due to the high complexity of tasks. Boeing famously implemented an AR solution using Google Glass with the Skylight AR platform for wiring harness assembly on aircraft. Each Boeing airplane contains about 130 miles of wiring in unique configurations. Traditionally, technicians relied on thick paper manuals of schematics, frequently looking back and forth, which was tedious and error-prone. With AR glasses, technicians can see the wiring diagrams overlaid on the actual aircraft structure in front of them, complete with step-by-step prompts. This reduces cognitive load and virtually eliminates errors. Boeing reported that using AR for wiring harness installation brought error rates down to zero and reduced production time by 25%. According to Randall MacPherson, a Boeing senior manager, this was a “step function change” rather than an incremental improvement – “wearable technology is helping us amplify the power of our workforce,” he noted. Such a drastic improvement in a critical process underscores AR’s value in aerospace assembly.

Augmented Reality enables hands-free guidance for complex tasks – for example, overlaying step-by-step assembly instructions for satellite components – thereby improving accuracy and speed on the shop floor.

Lockheed Martin has also embraced AR to assist technicians in building spacecraft and fighter jets. In one project, Lockheed’s space division partnered with Scope AR to create animated AR work instructions for assembling the Orion crew capsule. Instead of referring to binders or computer screens, technicians wear the Microsoft HoloLens headset, which overlays 3D CAD models and instructions onto the actual assembly process. Shelley Peterson, Lockheed’s AR project lead, explained that these tools “have accelerated the interpretation and presentation of workflow data, encompassing assembly, manufacturing, testing, and maintenance steps.” The impact has been dramatic: Lockheed reduced the time needed to interpret assembly instructions by 95%, cut overall training time for new technicians by 85%, and increased productivity on certain tasks by over 40%. These are staggering efficiency gains in an industry where even a 5% improvement is significant. For something as complex as the Orion spacecraft’s 5,000°F re-entry heat shield, AR ensured that every fastener and sensor was installed correctly. In fact, by guiding technicians with AR, Lockheed saves $38 per fastener on labor hours; with millions of fasteners used in aerospace manufacturing, the cost savings and quality improvements accumulate rapidly.

Aerospace AR is not limited to assembly; it is also used for maintenance and inspection. At Northrop Grumman’s Space Park facility, AR overlays technical diagrams onto equipment for rapid troubleshooting and provides remote expert support. AR has enabled subject matter experts from OEMs to guide on-site aerospace workers through repairs in real time, which is critical when a machine breakdown could halt production of a satellite or aircraft component. One case cited a bagging machine breakdown at a manufacturing plant that, without AR, would have taken weeks for an expert to diagnose in person, but was resolved in 30 minutes via AR remote assistance, thereby preventing extensive downtime. Such remote AR support became especially vital during pandemic travel restrictions, and it is now a standard tool to keep production on track.

Overall, AR in aerospace has demonstrated its ability to reduce human error to nearly zero, enhance assembly speeds by double-digit percentages, and significantly decrease the necessity for lengthy on-the-job training. As Oscar Castillo, a factory modernization lead at Northrop, summarized: AR provides “useful and relevant digital data” directly in view, which is ideal for complex aerospace manufacturing where even minor mistakes can be costly. These successes at Boeing, Lockheed, and Northrop are encouraging others in the industry to scale AR pilot programs into full deployments.

VR in Aerospace Design and Training

VR technology complements AR in aerospace by addressing design planning, simulation, and immersive training that benefit from a fully virtual environment. Boeing utilizes Virtual Reality for design reviews and the prototyping of aircraft and spacecraft. Engineers can virtually walk through a new airplane design, inspect systems, and even simulate the assembly process in VR to identify potential assembly sequence issues and maintenance access problems. This approach enables Boeing to catch design flaws early and iterate quickly without the need for expensive physical prototypes. For instance, Boeing has employed VR to refine the layout of the CST-100 Starliner capsule’s interior and to ensure astronauts can properly reach controls – all before cutting any metal.

Another critical use of VR is for training and simulation. Boeing’s aerospace programs include highly specialized training, such as virtual astronaut training for space missions and VR maintenance training for aircraft mechanics. By simulating scenarios- like orbital module procedures or emergency aircraft systems failures- in VR, trainees can experience and practice handling these situations in a risk-free environment. Boeing reported that VR training for its Starliner spacecraft enabled astronauts and ground crews to familiarize themselves with procedures much more thoroughly, reducing errors when they later performed real operations. On the manufacturing side, Airbus has developed VR training for its factory workers to practice assembling complex components. After implementing VR training, Airbus observed a faster ramp-up in worker skill levels and improved assembly consistency, as workers had essentially' done it before” virtually.

VR is also used in aerospace to validate manufacturing processes through digital twins. Siemens, a technology provider for aerospace, utilizes VR in its own gas turbine manufacturing and provides similar solutions to aerospace clients. One Siemens case demonstrated that VR maintenance training for large turbine engines reduced training time by 66% and increased certification pass rates by 13% among their technicians. Applying this to aerospace, comparable VR training for jet engine assembly or inspection can result in substantial time savings due to the complexity of those tasks. Furthermore, VR-based training has enhanced engagement – trainees are more motivated and confident, which improves knowledge retention and skill transfer on the shop floor.

Aerospace firms are now integrating VR with digital twin models of factories. Lockheed Martin’s “digital thread” initiative, for instance, connects design, simulation, and production. Before physically reconfiguring a production line for a new jet, Lockheed virtually simulates it in VR to optimize the layout and worker ergonomics. This eliminates costly trial-and-error on the actual shop floor and ensures a smooth ramp-up when the change is implemented. Given the enormous cost of aerospace production (a single mistake can scrap a multimillion-dollar part), VR simulation offers a safe testing ground, thereby conserving time and budget.

In summary, VR in aerospace manufacturing accelerates product development and ensures a well-trained workforce. It mitigates the high stakes of aerospace innovation by allowing

“fail-fast” iterations in virtual space. Combined with AI and AR, VR is helping aerospace giants like Boeing and Lockheed deliver complex projects more quickly while maintaining ultra-high quality and safety standards.

Electronics Industry: Boosting Smart Manufacturing with AI, AR, and VR

AI in Electronics Manufacturing

The electronics sector, including semiconductor and consumer electronics manufacturing, has been at the forefront of AI-driven smart manufacturing. Given the scale (millions of units or chips) and precision required (nanometer tolerances), AI is indispensable for optimizing yield, throughput, and energy usage. Samsung, for instance, extensively leverages AI in its semiconductor fabs and assembly lines. AI algorithms monitor equipment data from sensors and predict when tools might fail or drift out of calibration, enabling preemptive maintenance. This strategy has enabled some semiconductor fabs to achieve nearly 95% equipment uptime and minimize production interruptions. AI-based predictive models in chip manufacturing have significantly reduced yield loss – one case study noted that AI decreased overall semiconductor defect rates, improving yield by up to 30%. For a memory chip plant producing thousands of wafers a week, a 30% yield improvement translates to a substantial increase in output and cost savings.

Electronics manufacturers also utilize AI for quality control and defect detection that exceeds human capabilities. Bosch employs AI vision systems in its electronics factories to inspect tiny solder points and electronic components. At Bosch’s Dresden semiconductor fabrication facility (opened in 2021), an AI system analyzes sensor data to identify anomalies in real-time, ensuring process stability and high quality. AI-driven optical inspection at scale allows for early detection of problems, thereby reducing waste. Additionally, AI can execute advanced process control, automatically adjusting hundreds of process parameters in real-time to maintain production within optimal ranges – particularly critical in chip fabrication. One example from Bosch: their AI system in Dresden facilitates predictive maintenance and continuous quality improvement, sparing customers from time-consuming final tests and lengthy yield ramp-ups. This accelerates time-to-market for new electronic components.

Energy efficiency represents another success. Bosch’s Changsha electronics plant implemented an AI energy management platform that analyzes production schedules, weather conditions, and demand forecasts to optimize energy usage of equipment. As a result, the plant reduced its annual electricity consumption by 18% and CO₂ emissions by 14%, marking a significant achievement in sustainability and cost savings. AI’s capability to handle such multifactor optimization- balancing production needs, energy costs, and machine performance- results in a greener and more efficient operation.

Supply chain resilience is essential in the electronics industry, as demonstrated by recent semiconductor shortages, and AI plays a significant role here as well. Siemens has implemented AI in its component factories for dynamic supplier scheduling – if a shipment is delayed, AI algorithms re-optimize the production sequence to minimize idle time until parts arrive. This type of agility has enabled electronics lines to continue operating despite global disruptions. A Georgetown study observed that early adopters of AI in the supply chain significantly improved inventory turnover rates and could respond more swiftly to demand shifts. For instance, Apple’s manufacturers leverage AI to predict component needs worldwide, reducing excess inventory and preventing line downtime due to part shortages.

From a strategic perspective, AI is facilitating lights-out manufacturing (fully automated production) in certain electronics plants. By integrating AI-driven robotics control, real-time monitoring, and self-correcting processes, companies like Samsung and Foxconn are progressing toward factories that can operate 24/7 with minimal human intervention. These “smart factories” offer higher output, consistency, and safety. While not all electronics plants are fully automated, AI serves as the intelligence that makes partial automation significantly more efficient and scalable.

AR in Electronics Manufacturing

In comparison to automotive and aerospace, AR in electronics manufacturing is emerging rapidly. The assembly of electronics – whether it involves circuit boards, smartphones, or industrial controllers – often requires intricate procedures and thousands of tiny parts. AR is deployed to guide assembly operators through these complex tasks, enhancing both accuracy and speed. For instance, an electronics manufacturer might utilize AR glasses to project the correct placement of components onto a PCB (printed circuit board) while a worker solders or inspects it. This significantly decreases the likelihood of misplacing a component among the hundreds on a board. Foxconn, a major electronics assembler, has reportedly experimented with AR to train and assist its workforce in iPhone assembly, aiming to shorten the training time required for each new product introduction.

A notable case is Siemens, which produces industrial electronics (such as PLC controllers) and has implemented AR in its production processes and for customer solutions. In one project, Siemens combined AR with digital twin data to assist assembly workers in correctly aligning complex components. The AR system can highlight on a real part where connectors or screws should be placed, based on the product’s 3D model. As a result, even less experienced workers can effectively perform sophisticated assembly or maintenance tasks correctly on their first attempt. According to Siemens, “AR helps users achieve faster upskilling and fosters more confident workers by standardizing procedure execution and providing in-the-field guidance.” In electronics plants where product designs frequently change, this ensures high quality despite a dynamic environment.

Another application is AR for the maintenance of electronics production equipment. Semiconductor fabrication machines and testing rigs are extremely complex. Companies like ASML and Applied Materials, who supply chip-making equipment, now offer AR service guides. A technician wearing an AR headset can see overlays indicating which module of a machine to service, what steps to follow, and even live IoT data, such as temperatures and voltages, superimposed on the equipment. This shortens repair cycles and prevents errors that could damage the equipment. During the COVID-19 lockdowns, many chip fabs utilized AR to allow vendor experts to remotely guide their on-site engineers through complex repairs, solving issues in hours instead of waiting days for an expert’s physical visit.

Finally, AR is enhancing training and knowledge transfer in electronics manufacturing. Companies like Bosch have thousands of standard operating procedures for producing sensors and electronic control units. Now they are experimenting with AR training modules that visually demonstrate these procedures to new hires. Instead of reading manuals, trainees wear AR devices that display holographic hands performing tasks on an actual workstation, which the trainees can mimic. This immersive learning improves understanding and retention, similar to the benefits observed in other industries. Given the high turnover in certain electronics assembly roles, AR can significantly reduce the time needed to train replacements while ensuring consistent output quality.

VR in Electronics and Semiconductor Manufacturing

While not as widespread as in automotive, virtual reality is discovering valuable niches in electronics manufacturing. One significant application is in factory planning and layout optimization. Electronics factories, particularly semiconductor fabs, are highly complex environments where even minor layout changes can impact airflow, particle contamination, and worker safety. Companies like Intel and TSMC utilize VR models of their fabs to plan equipment installation and facility upgrades. By virtually walking through a new fab design in VR, engineers can identify spatial conflicts (e.g., a maintenance path that is too narrow, or a robot’s arm overlapping another station’s area) before the actual construction. This approach saves enormous costs – a mistake identified in VR costs virtually nothing to correct, whereas an error in a constructed cleanroom might necessitate costly retrofits and downtime.

VR is also used to simulate and optimize production processes. For instance, an electronics manufacturer can create a digital twin of a printed circuit board assembly line in VR. Process engineers then conduct virtual trials to determine how adding another soldering station or rearranging the order of assembly might increase throughput. These simulations, powered by real production data and AI, allow for the testing of dozens of scenarios overnight – far faster and cheaper than physical experimentation. Companies have reported being able to boost line throughput by 5–10% just from such virtual optimizations, which is significant in high-volume electronics production.

On the workforce side, VR training is beneficial in the electronics industry for safety and process training. Semiconductor fabs have strict protocols (for example, entering and exiting cleanrooms or handling hazardous chemicals for chip etching). VR training programs at firms like GlobalFoundries and Samsung allow workers to practice these protocols in a virtual fab environment. Since any lapse in a real fab can ruin products or jeopardize safety, VR offers a safe sandbox. Evidence shows that this leads to significantly fewer protocol violations; one internal study found that new fab operators who trained in VR committed zero safety infractions in their first three months on the job, compared to a few incidents typically observed with traditional training (internal data shared by a fab training manager). Moreover, VR can gamify the training, making it more engaging, and higher engagement has been linked to lower attrition in these often stressful jobs.

Electronics giants are also integrating VR with augmented analytics for decision-making. For instance, a manager can wear a VR headset and immerse themselves in a virtual operations control room that visualizes live factory data in 3D – similar to a holographic dashboard displaying all global factories, with AI alerts indicating where attention is required. Samsung’s manufacturing division has tested such immersive dashboards to oversee its various production sites. While still in the early stages, this concept holds promise in allowing executives to visually assess production health and delve into any facility as if they were physically present, potentially accelerating response times to issues.

In summary, the electronics industry’s adoption of VR focuses on ensuring

first-time-right decisions

and training within a highly precise manufacturing context. When combined with AI and AR, VR assists electronics manufacturers such as Bosch, Siemens, and Samsung in continuously improving efficiency, even as products and processes grow more complex. The result is smarter factories capable of ramping up new products faster while operating with fewer errors and less waste.

Conclusion and Recommendations for Manufacturing Leaders

In automotive, aerospace, and electronics manufacturing, AI, AR, and VR are proving to be essential tools for enhancing efficiency and competitiveness. They address traditional challenges – downtime, errors, lengthy training cycles, and supply chain complexity – with data-driven precision and immersive guidance. The highlighted case studies (from Boeing’s 25% faster wiring installation to Bosch’s 18% energy savings and Volkswagen’s VR-trained workforce) show that these technologies are not futuristic experiments but current solutions delivering significant ROI. As one AR provider CEO noted, “we’re at the point where the C-suite understands the viability and metrics that AR brings to the business.” Forward-looking CEOs and COOs in manufacturing are now advocating for these initiatives, rather than relegating them solely to IT departments.

For leaders interested in adopting or expanding AI, AR, and VR, here are key recommendations:

- Start with high-impact pilot projects: Identify a pressing problem (such as excessive downtime on a critical line, high defect rates in a process, or lengthy training requirements) and apply AI or AR/VR to address it. For example, implement an AI predictive maintenance system on the equipment causing the most unplanned downtime or trial an AR work instruction headset at a particularly complex assembly station. Early wins will build momentum and justify scaling the technology.

- Leverage Expert Partnerships and Case Studies: Engage with technology providers (AI software firms, AR/VR solution vendors) who possess experience in your industry. Learn from the case studies of peers, such as

Lockheed Martin’s use of AR to reduce assembly time, or how

Siemens implemented VR for training, to inform your approach. Many providers offer off-the-shelf AR work instruction platforms or AI analytics templates that can be customized, which accelerates deployment.

- Invest in Data and Infrastructure for AI: AI’s effectiveness relies on quality data. Ensure your production lines are equipped with the necessary sensors and data capture systems (IoT devices, quality tracking, etc.). Invest in cloud or edge computing infrastructure to manage AI analytics in real time on the factory floor. Additionally, upskill your IT and engineering teams in data science or engage experts to accurately interpret AI insights and incorporate them into decision-making.

- Prioritize Workforce Involvement and Training: Involve your workforce early when introducing AR and VR tools. These technologies transform how people work – technicians and operators should be part of the tool selection and pilot testing process. Provide training and emphasize that these tools are there to assist (not replace) them. Many companies discover that once workers experience AR/VR and see improved instructions or safer training, they become enthusiastic adopters. This buy-in is crucial for scaling across multiple sites.

- Measure KPIs and Scale Up: Define clear metrics for success – such as reducing average downtime by 30%, halving training time, and improving first-pass yield by 20%. Track performance during the pilot. If targets are met or exceeded (as Boeing and others discovered), be prepared to implement the solution in other lines or plants. Additionally, capture intangible benefits like enhanced worker engagement or customer satisfaction (by delivering on time with higher quality). These contribute to the business case.

- Foster a Culture of Innovation: Encourage plant managers and teams to continuously identify opportunities for AI and AR/VR integration. Consider creating a dedicated “Industry 4.0” task force or innovation lab to pilot new technology and share best practices company-wide. In a fast-evolving tech landscape, maintaining an innovative culture ensures that you keep pace or lead in adoption rather than falling behind catch-up.

In conclusion, AI, AR, and VR are powerful enablers of manufacturing efficiency and agility. They align well with lean principles – eliminating waste (downtime, rework, travel for experts), empowering workers with the right information at the right time, and enabling continuous improvement through data. The technology has matured to the point where even mid-sized manufacturers can implement affordable solutions (e.g., AR via tablets, AI through cloud services) and see immediate benefits. Manufacturing leaders who harness these tools position their companies to produce more

quickly, safely, and cost-effectively while also future-proofing their operations in a world moving toward smart factories. As the success stories of Toyota, Boeing, Bosch, and others demonstrate, the question is no longer

if AI and immersive technologies should be adopted, but

how quickly one can scale them across the enterprise to secure a competitive advantage edge.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Thank you for signing up to our monthly newsletter.

Please try again later.

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.

SUPPORT

Detroit

Saudi Arabia

BrandXR. All Rights Reserved. Website designed by Unleash Media.