Best AI Glasses of 2025

The artificial intelligence glasses market has reached its inflection point in 2025, with Meta's Ray-Ban collaboration demonstrating consumer demand and driving 210% year-over-year growth. The market is projected to expand from $1.93 billion in 2024 to $8.26 billion by 2030, representing a 27.3% compound annual growth rate. Industry analysts anticipate over 25 million AR glasses shipments by 2030 with 67% CAGR growth, while Meta currently dominates with over 60% market share and 2 million units sold.

For Fortune 1000 marketing executives, AI glasses represent a transformative technology that enables contextual advertising, immersive brand experiences, and unprecedented first-party data collection. Apple's Vision Pro sparked enterprise pilots in 50% of Fortune 100 companies within three months of its launch, while early AR advertising implementations demonstrate engagement increases of 30-40% over static ads and 67%+ social sharing rates for AR-enhanced attractions. The convergence of computer vision, natural language processing, and augmented reality creates opportunities for revolutionary customer engagement strategies that build on proven advances in out-of-home advertising technology.

The competitive landscape will intensify dramatically over the next 18 months, with Apple's late-2026 launch targeting Meta's dominance, Google's Android XR platform enabling multiple hardware partners, and Johnny Ive's $6.5 billion OpenAI collaboration promising breakthrough design innovation. Marketing leaders must evaluate platform strategies now to take advantage of this emerging category before market consolidation occurs.

Ray-Ban Meta leads through proven AI integration and consumer adoption

Meta's Ray-Ban Smart Glasses have established the AI glasses category through advanced artificial intelligence capabilities instead of basic smart features. With more than 2 million units sold since October 2023 and sales tripling year-over-year in Q1 2025, the partnership with EssilorLuxottica shows that consumers will embrace AI wearables when they provide real utility.

The device's 12MP ultra-wide camera, equipped with 1080p video recording at 30fps, enables Meta AI's "Look and Ask" feature, allowing users to receive contextual information about their environment through computer vision analysis. The Snapdragon AR1 Gen1 processor, featuring dedicated AI processing units, manages on-device inference, while five built-in microphones and open-ear speakers ensure clear audio quality. Real-time language translation supports English, French, Italian, and Spanish; Shazam integration offers instant music identification.

Technical specifications highlight consumer-ready design priorities: a 50-gram weight ensures all-day comfort, 4 hours of active usage with a 32-hour charging case capacity, and LED recording indicators address privacy concerns. The audio-focused approach without visual displays allows for immediate market deployment while Meta develops true AR capabilities for future generations.

Meta AI integration marks the first successful deployment of multimodal AI in consumer wearables, simultaneously processing visual, audio, and contextual data. Users can capture hands-free photos and videos, live-stream directly to Facebook and Instagram with one-touch broadcasting, and access voice-activated calling and messaging. First-person perspective content creation removes filming friction, enabling authentic "through the eyes" experiences perfect for influencer marketing and experiential campaigns.

Pricing accessibility drives mainstream adoption, with base models starting at $299 for clear lenses, $329 for polarized, and $379 for Transitions technology. The integration of prescription lenses adds $160-$300, positioning the product competitively against premium sunglasses while delivering advanced AI capabilities. Availability in over 15 countries, including the United States, Canada, the European Union, the United Kingdom, Australia, and India, demonstrates Meta's commitment to global scale.

Expanding

production capacity to 10 million units

annually by 2026 demonstrates Meta's confidence in ongoing demand growth. EssilorLuxottica's manufacturing expertise, combined with Meta's software platform, creates significant barriers to entry for competitors without similar partnerships.

Apple prepares smartphone-caliber challenge with privacy-first positioning

Apple's rumored smart glasses represent the company's most significant new product category since the Apple Watch, with CEO Tim Cook reportedly "hell bent" on beating Meta to market leadership. Bloomberg's Mark Gurman reports that Apple is targeting a late-2026 launch, with large-scale prototype production beginning in late 2025 through overseas suppliers.

The strategic approach initially focuses on non-AR smart glasses, emphasizing AI-powered environmental analysis while avoiding photo and video recording capabilities due to privacy concerns. This differentiation strategy capitalizes on consumer skepticism regarding Meta's data practices and integrates Apple Intelligence and Visual Intelligence technologies developed for the iPhone.

Custom silicon development inspired by the Apple Watch's low-power processors addresses the primary technical constraint limiting current AI glasses: battery life. A partnership with TSMC for mass production positions Apple to deliver superior performance per watt, potentially enabling all-day usage that current competitors cannot match. The "Atlas" internal study program tests competing products to identify feature gaps and optimization opportunities.

Apple's ecosystem integration advantage cannot be understated. Seamless iPhone connectivity, Siri voice processing, and integration with enterprise iOS deployments create compelling value propositions for organizations already invested in Apple infrastructure. The privacy-first positioning aligns with growing corporate data governance requirements while enabling innovative immersive learning and training applications that leverage Apple's advanced sensors and processing capabilities.

Industry analysts, including Ming-Chi Kuo, previously predicted timelines of 2025-2027, which are now consolidated around 2026-2027 for commercial availability.

The development of metalens

technology

suggests that Apple's long-term vision extends beyond smart glasses to true augmented reality capabilities, positioning the initial product as a foundation for platform development rather than as a standalone device.

Google's Android XR enables ecosystem competition through strategic partnerships

Google's Android XR platform significantly departs from earlier Glass Enterprise initiatives, shifting toward open ecosystem competition with Meta and Apple's proprietary methods. The collaboration with Samsung announced at Google I/O 2025 delivers reference hardware while allowing various manufacturers to develop distinctive products.

Gemini AI integration with Project Astra delivers superior contextual understanding compared to current market offerings. The platform's multimodal capabilities process visual, audio, and environmental data to provide anticipatory assistance instead of reactive responses. Real-time language translation with subtitle overlay and 3D navigation mapping demonstrates advanced AI integration.

The Warby Parker partnership, valued at $150 million, signals Google's recognition that integrating fashion drives consumer adoption. Additional collaborations with Gentle Monster and Kering create multiple pathways to the market without requiring Google to manufacture hardware directly. This strategy reduces capital requirements while accelerating time-to-market across various consumer segments.

The availability of the developer platform in late 2025 positions Android XR as a foundation for third-party innovation, akin to Android's smartphone strategy. Enterprise customers will gain access to standardized development tools and managed deployment capabilities that are essential for large-scale organizational adoption.

Privacy safeguards tailored for enterprise use fulfill corporate governance requirements that competitors focused on consumers may neglect. Google's expertise in enterprise software directly contributes to deploying smart glasses, creating unique value for Fortune 1000 implementations.

Meta expands market presence through Oakley sports performance positioning

Meta's Oakley partnership, launched on June 20, 2025, demonstrates strategic market segmentation that goes beyond Ray-Ban's fashion-focused positioning. The HSTN model targets athletes and sports enthusiasts with performance-oriented features while integrating Meta AI, thus expanding the total addressable market without cannibalizing existing Ray-Ban sales.

Enhanced technical specifications exceed Ray-Ban capabilities, featuring 8-hour battery life, 48-hour charging case capacity, and 50% faster charging (50% in 20 minutes). The 12MP ultra-wide camera supports 3K video recording, upgraded from Ray-Ban's 1080p ability. IPX4 water resistance and Oakley PRIZM lens technology ensure superior performance in varying environmental conditions.

The pricing strategy positions Oakley Meta as a premium offering, with standard models priced at $399 and limited editions at $499, featuring 24K PRIZM polarized lenses. The $100 to $200 premium over Ray-Ban models reflects enhanced performance features while remaining more accessible compared to traditional Oakley premium sunglasses.

Celebrity endorsements featuring Kylian Mbappé and Patrick Mahomes target global sports audiences, while specialized features such as golf wind conditions, cycling metrics, and surfing condition analysis showcase sport-specific AI capabilities. This specialization establishes a defensible market position that general-purpose competitors find difficult to replicate.

Market expansion into over 15 countries, with launches planned for Mexico, India, and the UAE in 2025, illustrates Meta's commitment to global growth. The multi-year partnership extension into the next decade ensures ongoing innovation and market development stability.

Johnny Ive's OpenAI collaboration promises breakthrough design innovation

OpenAI's $6.5 billion acquisition of Johnny Ive's startup "io Products" represents the most significant design investment in AI hardware history. The partnership merges OpenAI's leadership in AI with Ive's established expertise in consumer product design, creating potential for category-defining innovation by the 2027 commercial launch.

The 55-person team integration maintains creative independence while providing OpenAI resources for large-scale manufacturing. Former Apple executives Scott Cannon, Tang Tan, and Evans Hankey bring hardware development expertise that complements Ive's design philosophy. Ming-Chi Kuo reports that production plans target 100 million units, indicating massive market ambitions.

Manufacturing strategy emphasizes reducing geopolitical risks through assembly in Vietnam, avoiding supply chains dependent on China that limit competitors. The design philosophy focuses on "reimagining what it means to use a computer" with AI-first interfaces that may transcend the current limitations of smart glasses.

Up to $1 billion in additional funding from Emerson Collective and other investors offers resources for sustained development without the constraints of venture capital. The two-year prior collaboration indicates advanced development beyond typical startup timelines.

The platform independence strategy reduces reliance on the iOS and Android ecosystems, akin to Meta's Quest approach. This independence fosters optimized AI experiences without the limitations imposed by smartphone manufacturers, potentially generating competitive advantages in both performance and user experience.

Strategic marketing applications deliver measurable engagement improvements

Immersive out-of-home advertising turns static placements into interactive experiences, with early trials showing 30-40% increases in engagement compared to traditional static ads. AR glasses allow for automatic brand recognition and contextual content delivery without needing QR code scanning or app downloads. Passersby wearing AI glasses could see 3D product models come to life on billboards or receive personalized discount coupons floating beside store signage. This evolution builds on established AR billboard integration strategies that have already shown significant ROI improvements.

Interactive brand experiences through gamification create memorable consumer engagement, incorporating AR scavenger hunts, city-wide treasure adventures, and location-based storytelling to drive higher foot traffic and dwell time. One AR mural campaign in Miami achieved average engagement times of 76 seconds and generated millions of social impressions, demonstrating the viral potential of well-executed AR experiences. Brands can leverage these templates for sponsored AR installations that activate through AI glasses, transforming urban environments into immersive platforms for brand storytelling. The success of proven AR mural implementations offers blueprints for integrating AI glasses strategies.

Personalized, context-aware advertising utilizes AI processing to deliver relevant messages based on user location, activity, and visual attention patterns. Tourism boards can offer AR historical reconstructions when visitors gaze at heritage sites, while retailers can provide sustainability information or promotional content when shoppers focus on specific products. Consumer acceptance surveys reveal that 92% of Gen Z respondents desire AR for shopping experiences when it delivers genuine value rather than intrusive advertising. The transformation of retail through AR mirrors and virtual try-ons illustrates how AI glasses will seamlessly extend these successful implementations.

Hands-free influencer content creation removes production friction while preserving authentic first-person perspectives. Ray-Ban Meta's integration with Facebook and Instagram facilitates one-touch live broadcasting, ideal for experiential marketing campaigns where authenticity is prioritized over production quality. The five-microphone array and video stabilization features create professional-quality content without bulky equipment.

Real-time analytics and feedback collection offer unprecedented insights into engagement patterns in the physical world. Opt-in programs can create gaze heatmaps for digital billboards, measure attention duration for retail displays, and gather immediate feedback through interactions with AI assistants. These data streams allow dynamic content optimization and performance measurement beyond traditional footfall counting methods. The integration builds on established social media AR engagement strategies that show how wearable AI can enhance viral marketing potential.

Enterprise implementation validates commercial viability across industries

Boeing's manufacturing excellence program achieved an 88% first-pass accuracy rate and a 25% reduction in wiring production time through upgrades from Google Glass Enterprise Edition to Microsoft HoloLens 2. The implementation across 15 global facilities demonstrates scalable enterprise value in high-stakes environments where accuracy directly impacts safety and operational efficiency.

Walmart's training transformation deployed over 17,000 Oculus Go headsets across 4,600 stores, achieving a 10-15% increase in test scores with VR training while eliminating travel costs for training facilities. The program trained more than 1 million associates with unprecedented engagement levels, with "associates standing in line to get trained" according to company executives.

GE Aviation's engine inspection applications utilize AR-guided maintenance procedures to expedite and enhance the accuracy of inspections across seven active projects in twelve global locations. The high-stakes aviation environment confirms the reliability of AI glasses for mission-critical applications, where errors can have severe consequences.

Aptus Group's warehouse operations improved through Vuzix M400 smart glasses with AI and machine vision, delivering quantifiable performance gains: a 15% improvement in receiving products, a 24% increase in put-away performance, a 20% faster picking and packaging process, and a 16-minute reduction in average order processing time.

Marketing applications show superior engagement rates, with 35-40% higher engagement compared to static digital advertising, an average interaction time of 75 seconds versus 2-3 seconds for banner ads, a 300% increase in social sharing rates, and a 70% rise in brand recall following AR interactions. These results align with established examples of effective OOH advertising that illustrate how immersive experiences consistently exceed traditional methods across various industries and campaign objectives.

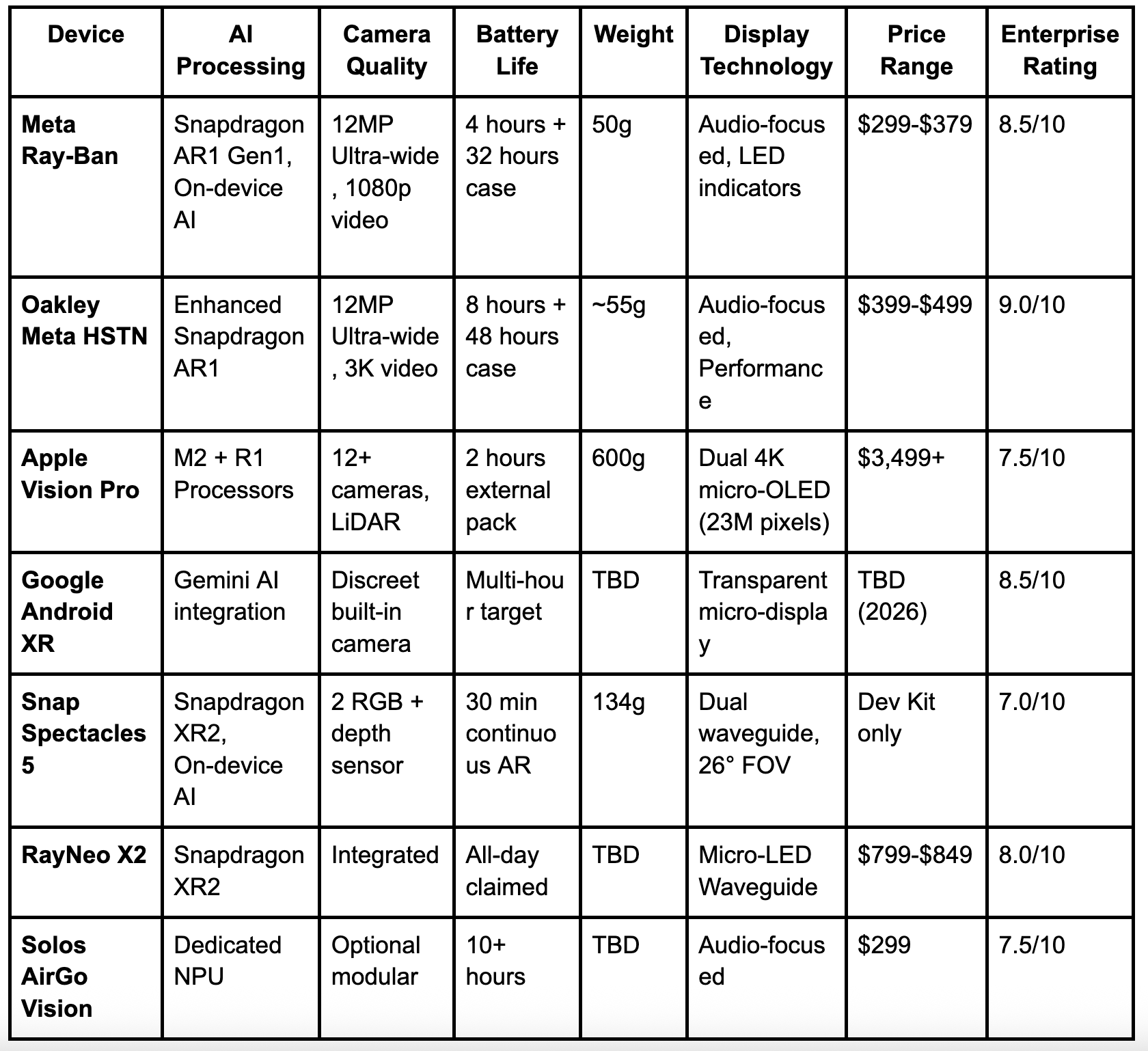

Technical specifications comparison reveals clear performance leaders

- Meta's products lead in AI integration maturity, showcasing proven computer vision capabilities, real-time translation, and voice-activated controls. The Snapdragon AR1 processor, equipped with dedicated AI processing units, enables on-device inference, reducing latency and improving reliability.

- Battery life remains the critical constraint across all products, with audio-focused devices delivering better performance than display-enabled alternatives. Meta's Ray-Ban and Oakley models illustrate that consumer acceptance necessitates a minimum of 6 hours of active usage with rapid charging capabilities.

- The enterprise scoring methodology assesses technical performance (25 points), AI capabilities (25 points), enterprise readiness (25 points), and value proposition (25 points). Meta Ray-Ban scores 78 out of 100 overall, with its strong AI capabilities and value proposition balancing out display limitations.

- NVIDIA's technological contributions accelerate hardware innovation through AI processing capabilities and breakthrough display technologies. The company's early 2025 patent for "backlight-free augmented reality digital holography" could enable ordinary-looking eyewear with vivid digital overlays, potentially reducing weight to Meta Ray-Ban levels (~50g) while delivering true see-through displays. NVIDIA CEO Jensen Huang's praise for Meta's secret "Orion" AR glasses prototype (100g) as having "potential to lead future technological advancements" signals industry recognition of approaching commercial viability.

- Johnny Ive's collaboration with OpenAI represents the most ambitious investment in AI hardware, with the $6.5 billion acquisition of "io Products," combining OpenAI's leadership in AI with proven expertise in consumer design. While the rumored device is not expected to feature visual displays,

its pocket-sized,

contextually aware, screen-free design could disrupt marketing channels through ubiquitous AI assistance. Sam Altman's goal of shipping 100 million units by late 2026 "faster than any hardware in history" demonstrates massive market ambitions that go beyond traditional smart glasses approaches.

- The convergence of spatial computing and ambient AI suggests that marketing strategies must adapt to consumers who have personal AI companions guiding their attention and recommendations. Brands need to ensure their locations and stories integrate with AI knowledge graphs, enabling spoken insights or recommendations triggered by environmental sensing rather than visual interfaces.

Market convergence accelerates through strategic partnerships and platform competition

The transformation of the global smart glasses market from $1.93 billion in 2024 to a projected $8.26 billion by 2030 reflects the convergence of artificial intelligence, augmented reality, and ubiquitous computing into mainstream consumer adoption. Industry projections of over 25 million AR glasses shipments by 2030, with a 67% CAGR, validate the platform's trajectory toward mass market acceptance, while Meta's early success confirms consumer demand and intensifying competitive responses stimulate market development.

Platform competition between proprietary ecosystems (Meta, Apple, OpenAI) and open standards (Google Android XR) mirrors historical smartphone market dynamics. Android XR's partnership strategy with Samsung, Warby Parker, and various manufacturers creates competitive pressure while lessening Google's capital requirements. The success of these partnerships will determine whether open or closed ecosystems prevail in the emerging category.

The integration of the fashion industry is essential for consumer adoption. Successful partnerships necessitate established eyewear expertise (Ray-Ban, Oakley, Warby Parker) rather than technology-first approaches. The $150 million Google-Warby Parker investment demonstrates the premium needed for authentic fashion collaboration, while Meta's 10-year extension with EssilorLuxottica ensures stability for ongoing innovation.

Technical challenges such as battery life, privacy concerns, and social acceptance are being systematically addressed through clear recording indicators (Meta), privacy-first positioning (Apple), and NVIDIA's low-power display innovations. As these barriers are resolved, accelerated adoption becomes inevitable, creating first-mover advantages for brands that establish AR marketing expertise early.

Competition among proprietary ecosystems (Meta, Apple, OpenAI) and open standards (Google Android XR) reflects historical dynamics of the smartphone market. Android XR's partnership strategy with Samsung, Warby Parker, and various manufacturers creates competitive pressure while lowering Google's capital needs. The success of these partnerships will determine whether open or closed ecosystems prevail in this emerging category.

Integration within the fashion industry is essential for consumer adoption, with successful partnerships requiring established eyewear expertise from brands like Ray-Ban, Oakley, and Warby Parker, rather than relying on technology-first approaches. The $150 million investment from Google into Warby Parker highlights the premium needed for genuine fashion collaboration, while Meta's 10-year extension with EssilorLuxottica ensures stability for ongoing innovation.

Technical challenges such as battery life, privacy concerns, and social acceptance are being systematically addressed through clear recording indicators (Meta), privacy-first positioning (Apple), and NVIDIA's low-power display innovations. As these barriers are resolved, the acceleration of adoption becomes inevitable, creating first-mover advantages for brands that establish AR marketing expertise early.

Strategic implementation roadmap for Fortune 1000 marketing leaders

Phase 1 (0-6 months): The pilot program development should focus on high-impact use cases demonstrating measurable ROI. Event marketing and trade show applications offer controlled environments for testing consumer acceptance and gathering performance data. Integrating existing marketing automation platforms enables seamless CRM data collection and campaign optimization. Organizations should assess their current OOH advertising inventory options to identify the best testing locations for AI glasses integration.

Platform evaluation criteria must balance current capabilities with the potential of future roadmaps. Meta's proven consumer adoption and enterprise case studies offer the lowest-risk implementation, while Google's Android XR platform provides long-term flexibility through multiple hardware partners. Apple's anticipated entry in 2026 presents timing considerations for organizations with significant iOS infrastructure investments. Understanding extended reality (XR) market dynamics is crucial for strategic planning across various platform options.

Privacy and compliance frameworks require proactive development before deployment. The implications of GDPR and CCPA for visual data processing, biometric information protection, and consent management create legal requirements that differ by jurisdiction. Enterprise data security necessitates AES-256 encryption, role-based access controls, and SOC 2 compliance verification.

Phase 2 (6-12 months): Scaled deployment should expand successful pilots across business units while focusing on change management. Employee training programs that emphasize benefits rather than efficiency gains enhance adoption rates. Integration testing with Salesforce Einstein AI, marketing automation platforms, and customer data platforms ensures seamless compatibility within the tech stack.

ROI measurement frameworks must capture a holistic impact across engagement metrics, conversion optimization, and operational efficiency improvements. Multi-platform attribution systems track customer journeys from AR interactions through purchase completion. Predictive modeling based on engagement patterns enables optimized targeting and personalization strategies.

Phase 3 (12-24 months): Full enterprise integration positions AI glasses as a core component of the omnichannel marketing strategy. Custom application development leverages platform APIs for industry-specific use cases. Partnership strategies with AR content creation platforms enable rapid campaign development without requiring technical expertise. Understanding the benefits of augmented reality murals and their proven engagement metrics provides frameworks for scaling AI glasses experiences across multiple touchpoints and geographic markets.

Conclusion: First-mover advantage requires immediate strategic action

The AI glasses market represents the most significant consumer technology platform opportunity since smartphones, with proven demand validation through Meta's 2+ million unit sales and enterprise adoption across 50% of Fortune 100 companies. Marketing leaders in the Fortune 1000 must begin strategic preparation immediately to capitalize on first-mover advantages before market consolidation occurs around 2027-2028.

Meta's current market leadership through its partnerships with Ray-Ban and Oakley demonstrates a successful formula: collaboration with the fashion industry, mature AI integration, accessible pricing ($299-$499), and proven consumer adoption. However, with Apple's anticipated entry in late 2026, Google's Android XR platform strategy, and OpenAI's radical approach to ambient computing, competition will intensify while expanding total market opportunities beyond current projections.

Enterprise ROI validation across Boeing, Walmart, GE Aviation, and Fortune 1000 implementations demonstrates that AI glasses provide measurable business value beyond experimental applications. The 30-40% engagement increase for AR advertising, social sharing rates exceeding 67% for AR-enhanced attractions, and average interaction times of 76 seconds support marketing investment strategies. Additionally, consumer acceptance surveys reveal that 92% of Gen Z is open to AR shopping experiences.

The convergence of artificial intelligence, augmented reality, and marketing automation presents unprecedented opportunities for contextual advertising, first-party data collection, and customer engagement innovation. Organizations that establish platform strategies, develop 3D asset libraries, and cultivate AR experience expertise today will secure competitive advantages as mainstream adoption accelerates toward the projected 25+ million unit shipments by 2030.

BrandXR's proven expertise in AR billboard and mural campaigns positions the company to leverage AI glasses adoption through expanded service offerings. The success of creating viral AR experiences, such as the Miami mural generating millions of social impressions, combined with relationships with Fortune 1000 clients, provides immediate market access for AI glasses integration services.

The convergence of out-of-home advertising

with wearable AI reflects BrandXR's

natural evolution from static AR installations to dynamic, personalized experiences delivered through consumer eyewear platforms. By leveraging

BrandXR's comprehensive AR solutions and no-code platform capabilities, marketing leaders can quickly prototype and deploy AI glasses experiences that build on proven engagement methodologies while pioneering next-generation consumer interactions.

TALK TO A PRO

We're here to bring your brand to life!

Stay Connected with BrandXR

Create Augmented Reality for Free!

Create, Publish, and Measure 3D Augmented Reality Experiences Without Having to Code.